Take control of your taxes with QuickBooks Online

Kick off the new financial year the right way with your tax information all in one place. Avoid nasty surprises and last-minute panics come tax season with QuickBooks. Whatever your business size and industry, we’ve got everything you need for a successful tax season.

GST in QuickBooks Online

Small businesses in Australia, Canada, Singapore, and the UK already rely on QuickBooks to help them track and report Goods and Services Tax (GST) and Value-Added Tax (VAT). With QuickBooks’ one-click tax reports, small businesses save hours each month.

Automatically track and calculate sales tax in seconds with QuickBooks Online. QuickBooks is pre-filled with common tax rates (VAT/GST/GCT/IVA/ITBIS/TOT) or, you can easily set up your own tax rates. Once set up, QuickBooks automatically tracks sales tax. Every time you create an invoice or expense, QuickBooks will automatically calculate tax for you. When you’re ready at the end of your financial reporting period, QuickBooks prepares an accurate activity statement to assist you with filing your tax return.

QuickBooks is prefilled with tax rates in the following countries: Argentina, Bahamas, Bahrain, Barbados, Cambodia, Colombia, Costa Rica, Dominican Republic, Ecuador, Haiti, Indonesia, Israel, Jamaica, Kenya, Nigeria, Panama, Saudi Arabia, Suriname, Thailand, Trinidad And Tobago, Uganda, Venezuela.

It’s time to swap manual data entry for automatic and accurate calculations and record-keeping. Snap and store business receipts and easily categorize your transactions in one convenient location, so you’re ready for tax time. Log in to your account anytime, anywhere using your smartphone, tablet, or computer.

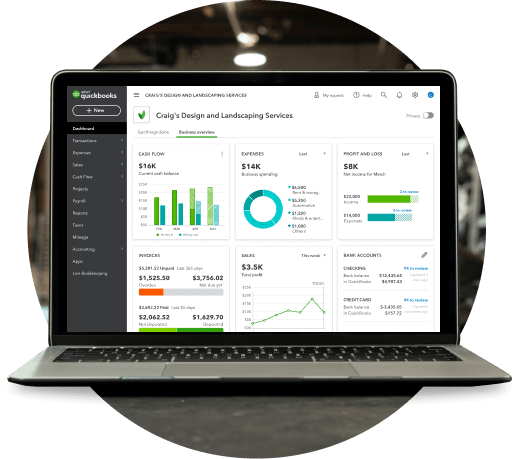

Take control of your cash flow and make smarter business decisions. See exactly how much you owe with our real-time dashboard and calculate your tax-related expenses.

Cut down on activity statement-related stress with QuickBooks’ automatic tax tracking and calculations. Always know how much you owe and when it’s due so you’re ready to file your taxes quickly and easily.

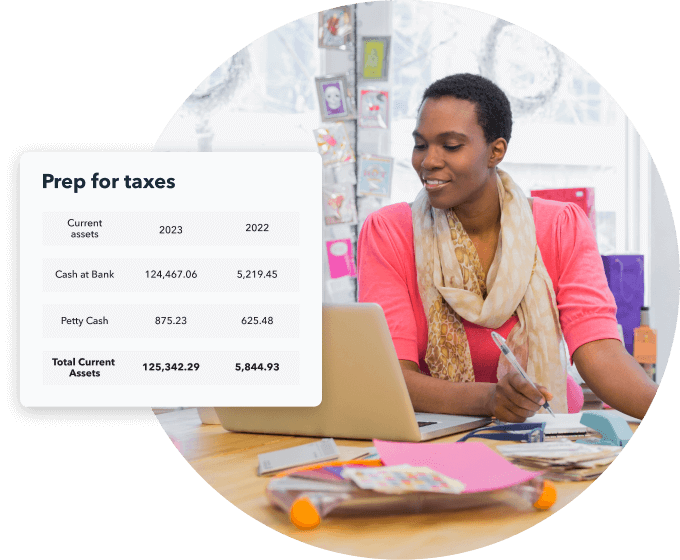

Use QuickBooks reports to create a tax summary for your review before you file your taxes. Use our tax calculator to reconcile your sales tax. You’ll be notified of any changes to old transactions, and they will carry over to your next summary.

How tax affects your sales, expenses and purchases

Invoices

QuickBooks automatically calculates and tracks sales tax within your invoices.

Expenses and Purchase Orders

QuickBooks automatically calculates and tracks tax within your expenses and purchase orders

One-click Forms

QuickBooks allows you to easily view your tax payable/receivable amounts in a few clicks, to help you prepare for lodgment.

Choose a plan to fit your needs.

Try FREE for 30 days!

Try FREE for 30 days!

See what customers and accountants have to say about QuickBooks Online.

Wai Hong Fong

CEO of Storehub Sdn Bhd

Stella

Chartered Accountant at QB Services Sdn Bhd

CT Chee

Chartered Accountant at AccPro Group

Anfaal Saari

CEO of Brotherhood Arts