Save time managing finances by connecting a bank so all your data's pulled into your QuickBooks account in real-time. Receipts and bills are automatically organised and matched to your transactions.

- Software with you in mindBecome a ProAdvisorJoin our free ProAdvisor Programme and access tools, resources and exclusive discounts to help take your practice to the next level.

- online Accounting for sole tradersfeatures for sole traders

- Grow your business

- How can we help you todayInvoices & expensesBanking & Payments

How can we help?

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Thursday

9.00am - 4.30pm Friday

Get product support

Contact support Visit support pageYour Business Expenses | Expense Management

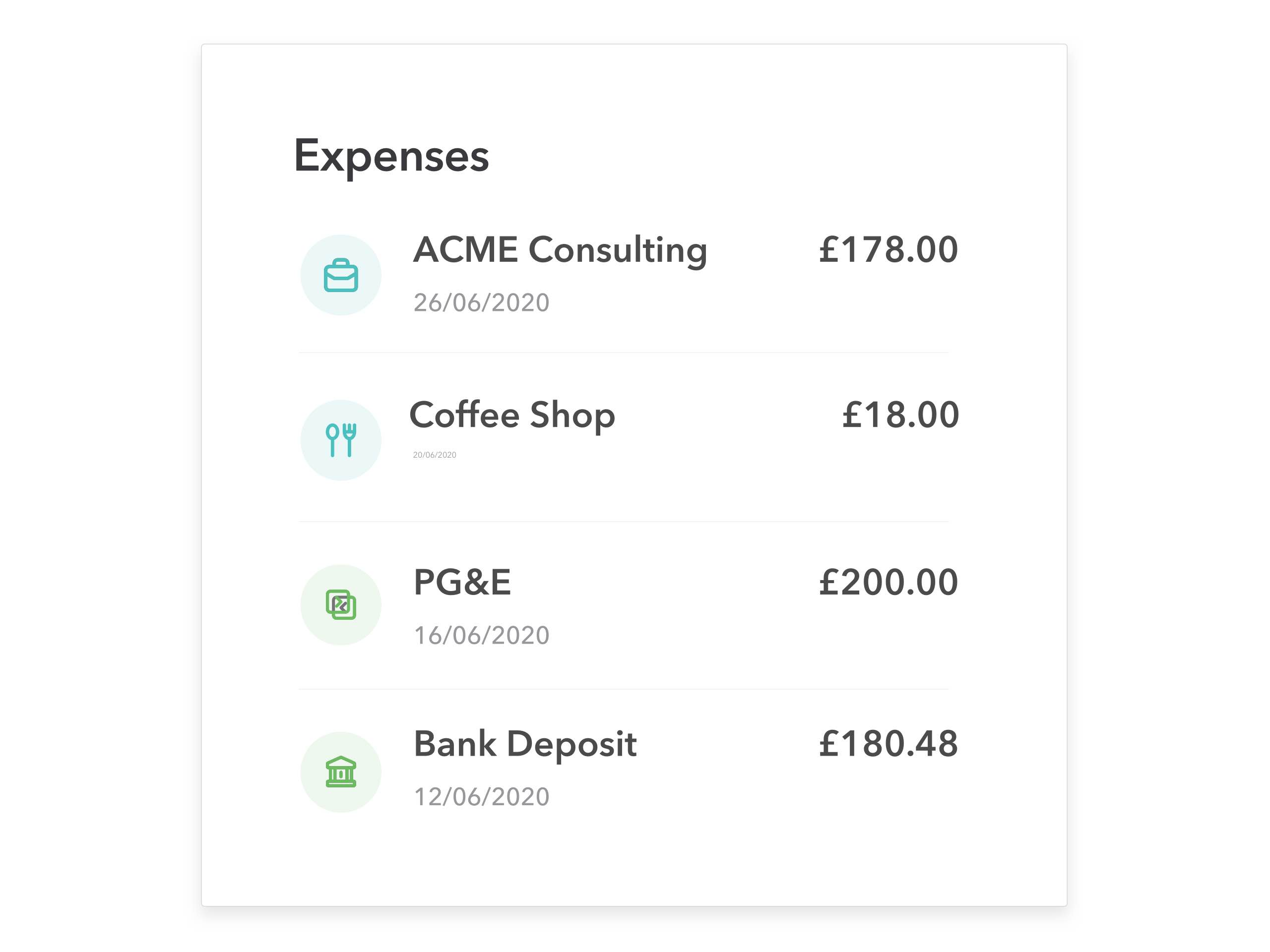

Automate your expenses and claim back hours of admin time

Say goodbye to data entry

Sort expenses without lifting a finger

QuickBooks extracts the important data and organises it into tax categories — that means less work at tax time.

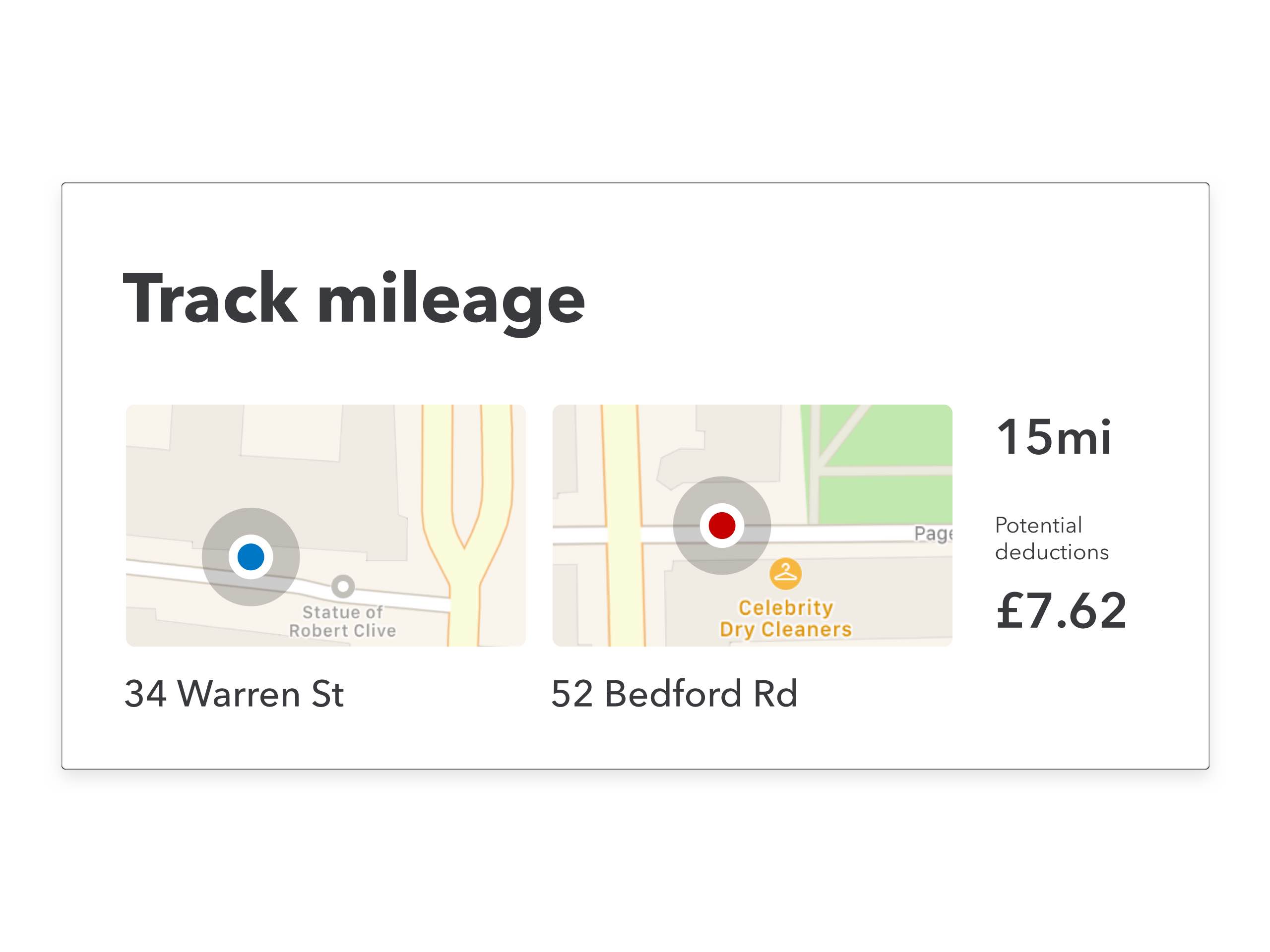

Drive down your tax bill

Claiming back money on your mileage? Don't miss a single trip. QuickBooks mobile app lets you track every trip, then mark your miles as business or personal travel.

Claim every allowable expense

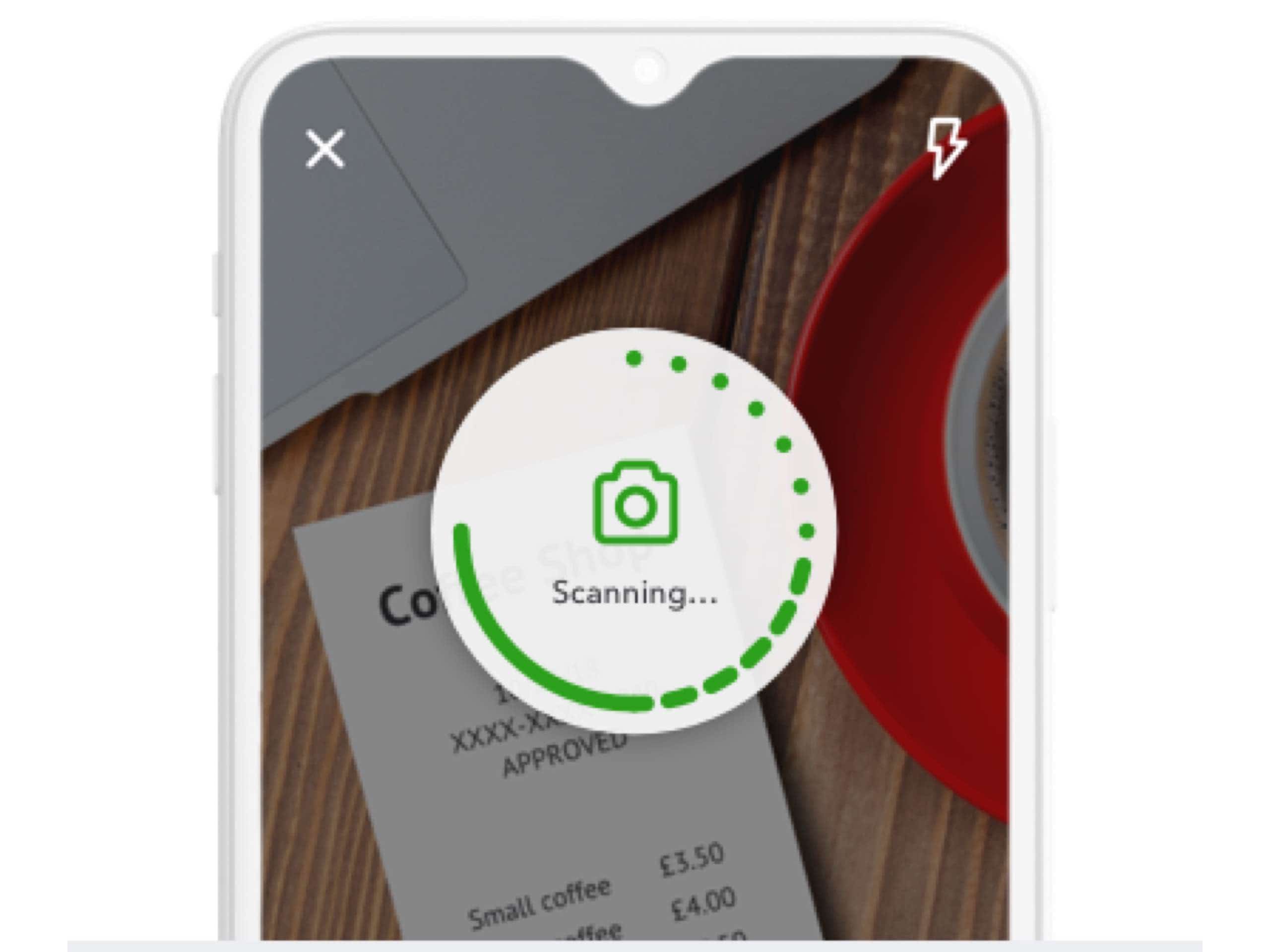

No more misplaced paperwork. Snap receipts and bills with our easy to use app. You can also email them to your QuickBooks account, individually or in batches.

Collaborate with your accountant

Real-time figures mean you both get a clearer picture of your business expenses. And staying in touch is simple with our in-app messaging feature.

Frequently asked questions

As you’d imagine, HMRC has some detailed rules about what is and isn’t permitted when it comes to claiming tax relief. As a general rule, it’s important that anything you’re claiming as a business expense is used entirely for business - not partly for your own personal needs.

It’s essential that you keep accurate records of anything you’re claiming for, but it’s not necessary to keep a paper copy of your bills and receipts, as long as you have a digital copies. QuickBooks securely stores these for you and organises them into categories that make sense.

If you want to upload expenses to your QuickBooks account you have three options:

- Take a picture of it on the mobile app for iOS or Android and follow the simple steps.

- Forward an email attachment to the email your specially created address in QuickBooks.

- Drag & drop a file into the receipts section.

Yes. QuickBooks Self Employed accounting software has been designed to support sole traders, self-employed workers and anyone working in the gig economy who needs to complete HMRC's Self Assessment tax return.

QuickBooks Self Employed lets you manage your expenses in the same way as QuickBooks Online, so you can lose the piles of paper receipts and have all your allowable expenses in order when it’s time to complete your tax return.

Most receipts process in an instant, but they can take up to 15 minutes.

Dozens of them. You can find the full list here. We’re consistently making more upgraded bank connections available to our customers and regularly announce the availability of new links, so watch this space.

Connecting your bank and credit cards to QuickBooks is another great way to save time on manual data entry and manage your expenses. Our machine learning makes reconciliation automatic - all you have to do is approve your transactions in a single click.

No, receipt and bill capture are both included as part of your QuickBooks subscription. We’ll organise them into categories ready for tax time, or you can create your own categories if you prefer. You can even run expense reports for your limited company to see where your day to day business costs are highest. And remember, if you use QuickBooks to stay on top of your expenses all year round, tax time will be a breeze.

Offer terms

If you select the Free Trial option the first months subscription to QuickBooks, starting from the date of enrolment, is free. To continue using QuickBooks after your one month trial, you'll be asked to present a valid credit card for authorisation, and you'll be charged the then current fee for the service(s) you've selected. All prices shown exclude VAT. Offer(s) are valid for new QuickBooks customers only. Offer cannot be combined with any other QuickBooks Online offers. Terms, conditions, features, pricing, service and support are subject to change without notice.

QuickBooks Making Tax Digital for VAT software is available to all QuickBooks Simple Start, Essential and Plus subscribers. Use of QuickBooks MTD for VAT software and bridging software must be aligned with HMRC's eligibility requirements and includes additional set up between the small business and HMRC.

QuickBooks MTD software currently supports Standard, Cash and Flat Rate schemes. QuickBooks Bridging Software supports Standard and Cash schemes. Annual submissions are not currently supported but will be coming soon. Businesses whose home currency is not GBP are currently not supported.

All prices shown exclude VAT. Your account will automatically be charged on a monthly basis until you cancel. No limit on the number of subscriptions ordered. You can cancel at any time by calling 0808 168 9533. Any discounts cannot be combined with any other QuickBooks Online or QuickBooks Self Employed offers. Terms, conditions, features, pricing, service and support are subject to change without notice.

60% discount valid until the 7 November 2020.

Call Sales: 0808 168 9533

© 2022 Intuit Inc. All rights reserved.

Registered in England No. 2679414. Address 5th Floor, Cardinal Place, 80 Victoria Street, London, SW1E 5JL, England. Intuit and QuickBooks are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.